Glossary

Explanation of terms for your everyday life as a parent

In everyday life as a parent, you often encounter technical terms and special words that are unclear or difficult to understand. For this situation we have prepared a list of definitions for you. Here you can find information sorted alphabetically. They help you to find your way around. You can translate and print this list in the language of your choice.

Application for diversionary child benefit:

Child benefit (see definition of child benefit) helps the parents with the costs of maintaining the child. Normally, the child benefit goes to the parents. However, under certain circumstances, child benefit can go directly to the child, for example, if the adult child no longer lives with the parents, but in his or her own home. To do this, you have to submit an application to the family insurance fund, the so-called branch application.

Single parent additional needs:

If you are a single parent with sole responsibility for the child and receive benefits from the job centre, you can receive further financial support. How much money you receive as a single parent depends on the number and age of the children. The single-parent allowance should be applied for at the Job Centre.

Unemployment benefit I (ALG I):

Unemployment benefit I (ALG I) is a benefit for unemployed people. ALG I is 60 percent (67 percent for children) of the last net salary and is paid regardless of savings. The application for ALG I is submitted to the local employment agency, where you must also register as unemployed. This assistance can only be claimed if you have worked for at least 12 months within a period of two years. In addition, you must be able to work at least 15 hours a week.

Unemployment benefit II (ALG II) (basic provision; colloquially also: Hartz 4):

Unemployment benefit II (ALG II) is paid to people who are in need of help. A further prerequisite is that they are fit for work (see definition of fit for work). Unemployment benefit is currently 432.00 euros per month for an adult person, and housing benefit can also be claimed. When ALG II is paid, a person's savings are included in the calculation and the entitlement is adjusted to the amount of ALG II. For example, parental allowance is also fully included as income and ALG II is reduced accordingly. In the case of means-tested households (see definition of means-tested households) the income of other persons living in the household is also taken into account.

Unemployment:

If you are not in gainful employment, you are unemployed. Unemployed people in Germany are entitled to unemployment benefit I (ALG I) or unemployment benefit II (Hartz 4). How much money you get depends on various factors. In order to receive financial assistance in the event of unemployment, you must apply to the relevant authorities and apply in person. For ALG I, the local employment agency is responsible, for ALG II the local job centre.

Consumer association:

A "Bedarfsgemeinschaft" means that the income of other persons living in the same household as the applicant is to be credited against unemployment benefit II or basic income support. This means that the amount of support is lower.

The word always appears when one wants to apply for certain financial benefits from offices. Especially at the job centre, the need community plays a major role, especially when it comes to unemployment benefit II (ALG II), for example. As a rule, a "Bedarfsgemeinschaft" means a family, a marriage or a registered partnership. For example, shared flats with friends are not included. A "Bedarfsgemeinschaft" is a group of people in a household who are so close to each other that they (must) support each other financially. However, the job centre sometimes tries to make the assumption of a shared household also in other living situations, e.g. when a man and a woman or two women or men live together.

Based on the community of need and the people who belong to it, the financial benefit that one receives is also calculated. Whether children belong to a means-tested community depends on the following conditions:

- The child is younger than 25 years

- The child is not married

- The child has no income or assets of its own

Vocational training allowance (BAB):

The vocational training allowance helps if you are in training and the wage is not enough to cover your own living costs. An important prerequisite is that you must be accommodated away from home for the purpose of training. In concrete terms, this means that the place of training - school or company - is so far away from home that you cannot commute. In order to receive this benefit, one must submit an application to the responsible employment agency. The amount of support depends on individual factors. You can calculate how much money you will receive online here.

Employment ban:

A prohibition of employment concerns pregnant women, who can be prohibited from working if there is too high a risk to their health from exercising the profession. The employment ban is issued by doctors and is there to protect expectant mothers and their unborn children. For example, prolonged nausea, vomiting or even stress can be a reason for a ban on employment. During this time the mothers continue to receive full pay.

Education and Participation Package (BuT):

The education and participation package is designed to prevent children and young people from being excluded from cultural and social life because their parents have low incomes. It can also apply to older (adult) persons - up to the age of 24 - if they are still attending school. The Education and Participation Pact applies, for example, if children or young people or their parents receive unemployment benefit II (ALG II), the child supplement, housing benefit or asylum seeker benefits.

The financial support includes school supplies (150 Euro), lunch and transportation for pupils are free of charge, the so-called participation fee (15 Euro per month, e.g. for sports club, etc.), or for extra tuition if the transfer is at risk.

Coaching:

Coaching is a certain form of support. The goal is to develop and be supported in certain topics. This can be, for example, the topic of family, career or relationships. Coaching can also be used to answer various questions or overcome challenges. A coach often accompanies a person over a longer period of time. Personal discussions are held and exercises are done. Through coaching you can question yourself and improve your life as well as your relationships.

Parental benefit:

The parental allowance supports parents who take care of their children after birth and therefore have no or lower income. The parental allowance amounts to up to 67 percent of the net income of the parent who looks after the child. It therefore depends on how much you earned before the child was born. There is a parental allowance calculator on the Internet where you can check how much money you are entitled to (Parental benefit calculator). Where you have to apply for parental allowance depends on the respective federal state. A list of application forms can be found here.

Parental leave:

Parental leave is available so that parents can take care of their child after a pregnancy. During this time, you are released from work and can take some time off. During parental leave you receive money from the state in the form of parental allowance. In order to be able to take parental leave, you must register in writing at least seven weeks before you start working. The maximum parental leave is 36 months per child. During this time you are also protected against dismissal.

Initial equipment (for the baby):

Families who receive unemployment benefit II (ALG II) can apply for initial provision for their newborn child. The families receive this in addition to the financial support of ALG II. The amount that is paid for initial provision depends on the individual case and the respective federal state. The application can be submitted to the responsible job centre. For this purpose, a maternal passport, identity card and proof of income are required. The best time to apply is between the 15th and 25th week of pregnancy.

Employment / gainful employment:

Employed people perform a job for which they receive a wage. This means that you are paid for your work. First of all, it does not matter what kind of employment relationship you have, for example whether you work part-time or full-time.

Earning capacity / employability:

To receive benefits from the Job Centre, you must be fit for work. You are considered fit for work if you can be available for work under normal conditions. The benchmark here is a minimum of 3 hours a day on which you could work in principle. If you are not able to work, you cannot apply for ALG II. The social assistance is then responsible for this.

Family benefits:

In Germany, parents and families receive certain benefits to support the life of their parents. Which benefits you receive depends on certain conditions. You can find out exactly what these are here.

Early help:

Becoming and being parents can be very challenging. That is why the Early Intervention is there. Different professionals from areas such as health, youth welfare and early intervention come together in this network and offer different kinds of support. The early support services are voluntary and free of charge. For example, the Early Intervention Services offer consultation hours or the placement of midwives. Here you can find more information about the Early Intervention Services.

Midwife:

Midwives accompany women and families during pregnancy, delivery and also afterwards. They provide support and assistance with questions concerning the birth and care for mothers during the intensive period of pregnancy. They help with care, tips and advice and make sure that mother and baby are well. All pregnant women are entitled to a midwife. The costs are covered by health insurance. Since every mother has different demands on a midwife and sympathy and a good feeling also play a major role, it is best to find a midwife for yourself. The best way to find a midwife is through your own social environment such as friends, acquaintances or colleagues. Doctors, pharmacies and health insurance companies can also help you.

Social Services:

The youth welfare office is an institution that supports parents. There are numerous offers, projects and measures which are there to improve the conditions for the everyday life of families. The focus here is on topics related to education, upbringing and care. To get help as a parent, you have to contact the Youth Welfare Office and make an appointment for an initial consultation. During this appointment, they will then discuss which help is best suited.

Child support:

Child benefit is intended to provide financial relief or support to parents in terms of the maintenance costs for their children. As a rule, it must be applied for at the family fund of the employment agency - for employees in the public sector: at the employer. At present it amounts to 204 Euros for the first and second child, 210 Euros for the third and 235 Euros for the fourth child. This benefit is paid in any case for all children up to the age of 18. For older children up to the age of 25 there is child benefit if they are in training or studying. Children who are unemployed receive it until the age of 21.

On 1 January 2021, the child benefit will be increased to 219 euros for the first and second child, 224 euros for the third and 250 euros for the fourth child.

Daycare voucher:

In some federal states - e.g. Berlin, Hamburg - a Kita-Gutschein is issued to parents. The voucher states that a child can spend many hours a day or week in the Kita or with a day care person and receives state funding for this. The Kita-Gutschein must be applied for at the youth welfare office of the responsible municipality (in Berlin: district). Parents can then use this voucher to register their child in a Kita and hopefully get a place. It is much more complicated in detail, but unfortunately we cannot go into that here.

Health insurance (statutory):

The statutory health insurance scheme provides cover for people in Germany in the event of illness by covering the costs arising, for example, from an illness. If you are not insured in any other way, for example through a private insurance company, the statutory health insurance is compulsory for everyone in Germany. It not only covers the costs of illness, but also those of pregnancy and maternity.

Short time:

If the employer is not doing well economically, he can temporarily send his employees on short-time work. This measure protects the employees from dismissal and at the same time relieves the employer economically. At the end of the month, employees on short-time work receive 60 percent of their normal salary. If you have children and are on short-time work, you will receive 67 percent at the end of the month. During the current Corona crisis, higher rates were also set for longer periods of short-time work.

More information on the amount of the short-time working allowance can be obtained from the local Federal Employment Agency.

Maternity pay:

The maternity allowance supports expectant mothers who are no longer able to carry out their professional activity for reasons of protection. The money is paid by the statutory health insurance funds. The application is also made here. In total, one can receive up to 13 euros per day. Payment is made during a period of six weeks before the birth and eight weeks after the birth. The application can only be made if you were previously in an employment relationship. A certificate for the expected date of delivery is required for the application.

Broadcasting contribution / broadcasting fees:

In Germany, everyone must pay radio licence fees from the age of 18 as soon as they start living in their own household. If you share a flat with other people, you only have to pay one fee. You can find more information under this Link.

Exemption from broadcasting fees (exemption from GEZ contributions):

Under certain conditions, one can be exempted from the broadcasting contribution (link). This is the case, for example, if you receive benefits from the job centre or have a low income for other reasons (training, studies, etc.). To get an exemption from the payment, you have to fill in an application form. You can do this in writing or online here. (See also: letter of exemption from broadcasting fees)

School registration:

In Germany there is compulsory schooling, i.e. every child must attend school as soon as he or she reaches a certain age. The federal states have different regulations here, usually school starts at the age of six. Under certain conditions, however, a child can be enrolled at school sooner or later.

In order for a child to go to school, it must be registered in advance. The registration depends on the place where the family lives. In general, parents will be contacted by the school administration office and informed about the next steps. With this letter they will also receive information about which school is suitable for the child. The following documents are necessary for registration at the school:

- The identity card or passport of the parents

- The birth certificate of the child of school age

- The letters received from the school administration office

Additional needs during pregnancy (additional needs during pregnancy):

If services are obtained from the job centre, you can apply for additional needs during pregnancy. In this way, in addition to your regular requirements, you will receive a sum to cover special costs. For example, the additional financial benefit is intended for special nutrition, care products or pregnancy clothes. In order to receive the money, you have to inform the job centre about your pregnancy. The amount of the extra benefit depends on various factors and is calculated by the Jobcentre staff.

Custody:

The word custody refers to the parental right and duty to care for and bring up his child. Custody of the child is valid until the child reaches the age of majority. After the birth, the mother is initially entitled to sole custody. By a corresponding declaration at the youth welfare department the mother can agree to the common custody. In this way, both parents share custody and are therefore jointly responsible for the child.

Child support:

All children in Germany are entitled to maintenance. This means that children are entitled to a certain amount which can be paid in cash or in kind. The payment in kind includes, for example, accommodation in the parental home, daily meals, etc. In this way, a child is economically secure. If the parents live together and share a household, there is usually no problem with joint maintenance. If the parents are separated and also live in different households, certain maintenance payments must be made. These depend on the income of the parent and are calculated according to the so-called Düsseldorf table.

Advance on alimony:

This help is for single parents. If a single parent receives no or only irregular maintenance from the father or mother for the child, the maintenance advance can be applied for. The local youth welfare office is responsible for this and can be contacted. There is no income limit for the advance maintenance payment. It is graded according to the age of the child:

- For children from 0 to 5 years up to 165 Euro

- For children from 6 to 11 years up to 220 Euro

- For children from 12 to 17 years up to 293 Euro

Acknowledgement of paternity:

Recognition of paternity is necessary if the two parents are not married when the child is born. In this way, shared custody of the child is ensured. The recognition can be done in different offices. For example, one can go to the youth welfare office or the registry office. In the youth welfare office the application is usually free of charge. In general, however, costs of up to 30.00 euros can be incurred. The following documents must be submitted for recognition:

- Identity card

- Birth certificate of the child or maternity certificate before birth

Housing benefit:

The housing allowance is a subsidy for rent costs if the income is not sufficient to pay the rent. The amount of the housing allowance depends on various criteria, such as the local rent index. In order to get housing benefit, you have to apply to the local housing benefit office.

Published on

Topics

Articles on the topic

-

How do I find a school place for my child?

Depending on the state and type of school, different things need to be...

-

Childcare - how does it work in Germany?

The path from application to daycare place is simple and complicated at...

-

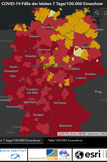

Controversy: open schools or close schools?

Politicians should react now to slide unprepared into a forced closure....

-

Corona pandemic severely disadvantages children and young people - but there is no "Corona generation"

This is a core finding of the anthology "Generation Corona? How young...

-

What to do after the Easter holidays? - Part 2: Final exams

An overview of the regulatory diversity

-

Kitas and schools in a state of flux

Update from 9.4.2021 on the current regulations